Remember our discussion on how call and put volumes are used by some investors to measure sentiments? Investors who buy ‘out-of-the-money’ call options anticipate the underlying stock price to spike. Recenly Softbank bought $4B worth call options on its holdings AMZN and MSFT. Many investor interpret this move as a buy signal on these equities and this may have led to spike in prices. This ends up escalating the valuation of these companies even though the underlying business models don’t justify these levels of valuation. Click on the image below to read an interesting article on this topic.

Category: Private Equity

Negative oil prices? Anticipate Loan Calling and …….Name Calling!

Something bizarre happened on April 20th! Yes, some oil futures contracts went negative and it has never happened.

What does a negative oil price mean? Drillers have extracted oil from the ground and they are out of storage capacity. So they would pay wholesale buyers money to take the oil off their hands. Imagine that! We discussed negative interest rates in the class and I explained that it’s like charging you storage/safe-keeping for your money. This is a similar scenario. This can lead to another problem. In our PE and CEO 2030 classes we discussed how when the underlying price of the collateralized assets crash may lead lenders ‘calling the loans’. The Loan Calling is an industry jargon that describes a demand by the lender for loan repayment even though it’s not due. Those companies that used their oil in the ground as a collateral may be receiving Loan Calls since the collateral has lost value due to crash in oil prices. Click the following article and send me your views to my Stanford email ID.

Remember our discussion on Hostile Takeovers in the PE, CEO classes and on how countries are vulnerable?

The heading in one of my slides was ‘How to take over a country peacefully?’. My answer was ‘by taking over the vital companies in that country’. I hope you remember that discussion in the PE/CEO 2030 class. The COVID situation may make scuh scenarios a reality. India is addressing this issue. Please read on. As usual send your views to my Stanford email ID.

M & A galore in the horizon? PE funds have been hoarding cash and waiting for this moment!

Private Equity firms have more than 1$ Trillion in cash! This could be the beginning of a once in a lifetime investment opportunity for those in waiting. Remember the discussion in the CEO-2030 class how the 2007 financial crisis opened up opportunities for acquistions and thus a spike in demand for new CEOs? CNBC had an intetresting article on this topic. Please click the image below. Should companies take PE’s money or not? Do they even have an option? What if the PE firms go hostile? I’m interested in what you have to say on this.

Corporations run out of cash! Blame the buybacks? Remember our discussion in the class!

Should large corporations assume that governments have their back? I said in the class that when interest rates are low, companies take on debt and often put it to good use. Remember our discussion on overdoing it? Some aspects of what we discussed are addressed in this CNBC article. Click the image below to read further.

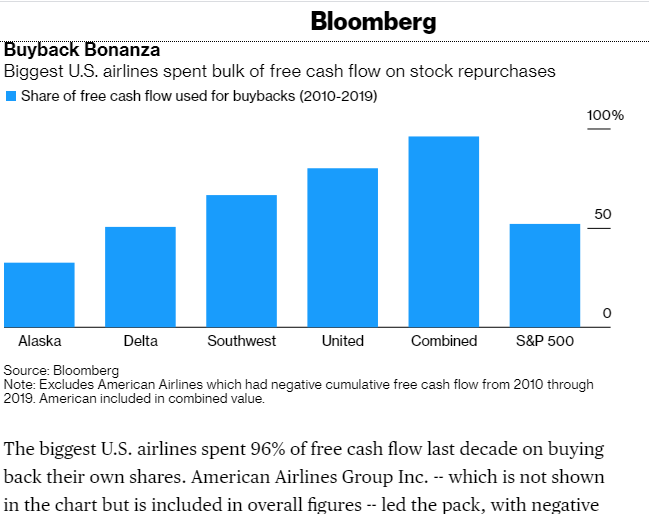

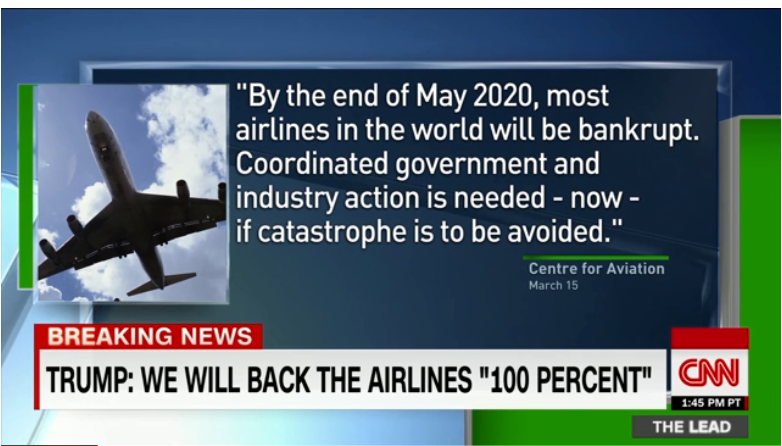

Our discussion on share buyback in the CEO-2030 and PE classes – Timely articles in Bloomberg and CNN

These articles in Bloomberg and CNN discuss how the airlines in the US spent their free cash flow to buy back their shares. It raises so many points we discussed in the class. But, did the money really disappear? Where did all the money go? CNN reports “The Big Four Airlines, according to Baldwin’s office, spent $42.5 billion on buybacks between 2014 and 2019. That nearly matches $50 billion the industry is now asking for”. What a coicidence! I Would like to hear from those who disagreed with me. Click on the images below.

PE’s role in the financialization of healthcare

In PE class we discussed how PEs can play both a positive and potentially negative role. I couldn’t play this video in full. Please click on the link below to watch it in full.