CNBC reported “Revenue declined from $23.33 billion a year earlier and from $25.17 billion in the fourth quarter. Net income dropped 55% to $1.13 billion, or 34 cents a share, from $2.51 billion, or 73 cents a share, a year ago.

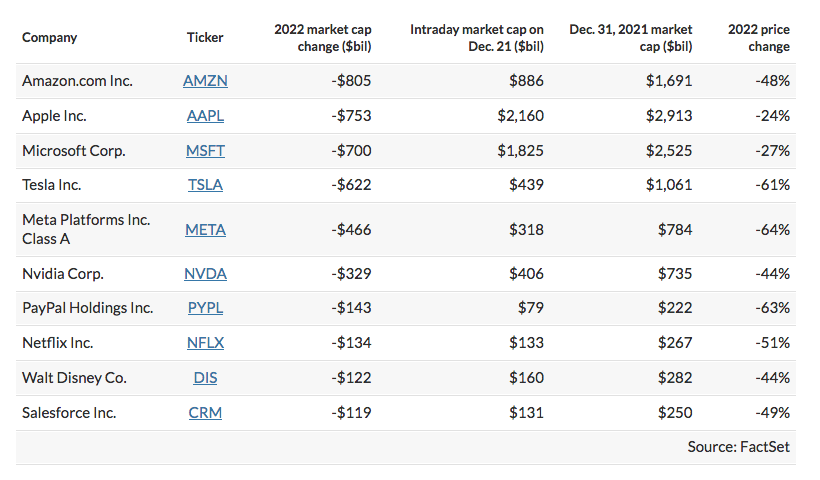

The drop in sales was even steeper than the company’s last decline in 2020, which was due to disrupted production during the Covid-19 pandemic. Tesla’s automotive revenue declined 13% year over year to $17.38 billion in the first three months of 2024.

Capital expenditures rose to $2.77 billion, up 34% from a year earlier.

Free cash flow turned negative in the quarter, with the company reporting a deficit of $2.53 billion. A year ago, Tesla reported free cash flow of $441 million, a number that reached $2.06 billion in the fourth quarter.”

Despite such numbers, Tesla shares jumped 11% after Musk reported that he is planning to manufacture affordable models in 2025. Does this mean that the market is looking at the future rather than the past? Click the URL below to read the article in CNBC. Ram Subramaniam

https://www.cnbc.com/2024/04/23/tesla-tsla-earnings-q1-2024-.html