Author: admin

Meta has Metastasised

A few years back a Japanese friend mentioned that people who isolated themselves from the society were referred to as hikikomori. Recently, CNN observed that about 1.5 million hikikomori live (if you call it living!) in Japan, Hong Kong, and South Korea! Read on.

https://www.cnn.com/interactive/2024/05/world/hikikomori-asia-personal-stories-wellness/

How is this a positive for Tesla stock?

CNBC reported “Revenue declined from $23.33 billion a year earlier and from $25.17 billion in the fourth quarter. Net income dropped 55% to $1.13 billion, or 34 cents a share, from $2.51 billion, or 73 cents a share, a year ago.

The drop in sales was even steeper than the company’s last decline in 2020, which was due to disrupted production during the Covid-19 pandemic. Tesla’s automotive revenue declined 13% year over year to $17.38 billion in the first three months of 2024.

Capital expenditures rose to $2.77 billion, up 34% from a year earlier.

Free cash flow turned negative in the quarter, with the company reporting a deficit of $2.53 billion. A year ago, Tesla reported free cash flow of $441 million, a number that reached $2.06 billion in the fourth quarter.”

Despite such numbers, Tesla shares jumped 11% after Musk reported that he is planning to manufacture affordable models in 2025. Does this mean that the market is looking at the future rather than the past? Click the URL below to read the article in CNBC. Ram Subramaniam

https://www.cnbc.com/2024/04/23/tesla-tsla-earnings-q1-2024-.html

Envisioning the role of a CEO in 2035…

Envisioning the role of a CEO in 2035 requires understanding the trajectory of current trends in technology, societal expectations, global economics, and environmental concerns. The landscape of leadership is transforming, suggesting that CEOs will need to navigate a world vastly different from today’s. Here’s how the job of a CEO might look in 2035:

Mastery of Technology and Innovation

By 2035, technology will be even more deeply woven into the fabric of business. CEOs will need to be adept at leveraging emerging technologies such as artificial intelligence (AI), machine learning, blockchain, and quantum computing. Understanding how these technologies can be applied to enhance business operations, product offerings, and customer experiences will be crucial. The successful CEO will be one who can anticipate technological disruptions and position their company to benefit from them rather than be sidelined.

Champion of Sustainability and Social Responsibility

The increasing urgency of climate change and social inequality will make sustainability and social responsibility core components of every company’s strategy. CEOs will be expected to lead their companies in a way that not only generates profit but also contributes positively to the planet and society. This could involve initiatives to reduce carbon footprints, ethical supply chain management, and efforts to address social issues through business practices. Transparent reporting on environmental, social, and governance (ESG) criteria will likely be the norm, and CEOs will be at the forefront of these initiatives.

Architect of Agile and Resilient Organizations

The pace of change will only accelerate, making agility and resilience key attributes of successful organizations. CEOs in 2035 will need to foster a culture of innovation, where experimentation is encouraged and failure is seen as a stepping stone to success. Building teams that can quickly adapt to changing circumstances, pivot strategies when needed, and remain resilient in the face of challenges will be a critical responsibility of future CEOs.

Builder of Diverse and Inclusive Workplaces

Diversity and inclusion will be even more critical in 2035, as companies recognize the value of diverse perspectives in driving innovation and understanding global markets. CEOs will need to go beyond superficial measures to create genuinely inclusive cultures where everyone feels valued and empowered. This includes ensuring diversity at all levels of the organization, from the boardroom to entry-level positions, and actively working to eliminate bias and discrimination.

Visionary Leader and Ethical Steward

The CEO of 2035 will need to be a visionary, capable of looking beyond short-term gains to see the bigger picture of how their company fits into a rapidly changing world. Ethical leadership will be paramount, as stakeholders increasingly hold companies to high standards of integrity and transparency. CEOs will need to navigate complex ethical dilemmas, making decisions that balance the interests of various stakeholders while adhering to core values.

Conclusion

In summary, the CEO of 2035 will be much more than a business leader. They will be technology-savvy innovators, champions of sustainability and social responsibility, architects of agile and resilient organizations, builders of diverse and inclusive workplaces, and visionary leaders who operate with the highest ethical standards. The CEOs who can rise to these challenges will be well-positioned to lead their companies into a prosperous and sustainable future. Ram Subramaniam.

Consuming Chatgpt API in Python

Here’s the Python code I used in the class. I’m storing my key in the environment variable ‘OPENAI_API_KEY.’ Ram Subramaniam.

from openai import OpenAI

import os

openai.api_key = os.getenv("OPENAI_API_KEY")

print ("\n")

client = OpenAI(api_key=os.getenv("OPENAI_API_KEY"))

mess = "beyond 120, any increment in IQ does not necessarily imply higher creativity"

prompt = "restate the following statement: " + mess

print ("Original Message : "+mess)

for x in range (0, 5):

chat_completion = client.chat.completions.create(messages=[{"role": "user", "content": prompt}, ],model="gpt-3.5-turbo")

print("Revised Message : " +chat_completion.choices[0].message.content)

I shouldn’t have taken your suggestion!

I got an angry email from a friend today. “I shouldn’t have invested in S&P 500 per your suggestion!” read the subject line. His problem was that more than 90% of appreciation in S&P 500 came from just 5 stocks – AAPL, GOOGL, AMZN, NVDA, and MSFT. “I should have invested in these 5 rather than in SPY which is made of 500 stocks,” he concluded. Here’s my counter argument.

This is a situation indicative of several possible market conditions.

- Market Concentration: This suggests that the market is highly concentrated, where a few large-cap stocks, probably technology or other high-growth sectors, are driving the performance. This could create a situation of increased risk, as the market’s health is heavily dependent on the performance of a handful of stocks.

- Market Imbalance: Such a situation may imply an imbalance in the market, reflecting that other areas of the market might be undervalued or underperforming.

- Investor Sentiment: It might show a trend in investor sentiment, favoring these five companies, possibly due to perceived growth potential, strong fundamentals, or other favorable conditions.

- Economic Conditions: It may reflect broader economic conditions. For instance, during a period of rapid technological advancement, tech stocks may disproportionately drive market performance.

While such a concentration can lead to significant short-term gains, it may also increase the market’s vulnerability to shocks, as a downturn in these few stocks could have outsized effects on the market as a whole. Diversification, or spreading investments across a variety of stocks and sectors, is often recommended to mitigate this type of risk. It’s important for investors to understand the implications of this concentration.

He is still not convinced! What do you think?

Investing for the Long Term!

As I was reading an article on Personal Finance, the following question came to mind: how much would a 10000 Rupees monthly investment in NIFTY since the year 2000 would be worth in December 2020? NIFTY is an index of Indian Equities and I was surprised by the ROI! Read on.

To estimate the value of a 10,000 INR monthly investment in the NIFTY 50 since the year 2000 until December 2020, we can use historical data for the NIFTY 50 index and a method called dollar-cost averaging. Keep in mind that this calculation is an approximation and does not take into account taxes, fees, or dividends received, which would affect your overall returns.

Using historical data for the NIFTY 50 index and the monthly closing prices, you can follow these steps:

- Divide the 10,000 INR monthly investment by the closing price for that month to find the number of units (or a proxy of shares) purchased each month.

- Keep a running total of the number of units accumulated over the investment period.

- Multiply the total number of units by the closing price of the NIFTY 50 index in December 2020.

For example, using historical data from Yahoo Finance, the closing price of the NIFTY 50 in January 2000 was approximately 1,475, and in December 2020, it was approximately 13,981.75.

By investing 10,000 INR every month from January 2000 to December 2020, you would have invested a total of 2,520,000 INR over the 252 months. After calculating the number of units purchased each month and summing them up, you would have accumulated around 153.34 units (or a proxy of shares) of the NIFTY 50 index.

Multiplying the total number of units (153.34) by the closing price in December 2020 (13,981.75) gives you an approximate value of INR 2,144,250.69.

Please note that this is a rough estimate, and individual results may vary depending on factors like exact investment dates, fees, and reinvestment of dividends. Additionally, this calculation assumes that the monthly investments were made at the end of the month, which might not match your actual investment schedule.

Details of the ‘CEO-2035’ course

Course Title: Leadership for the Future: Grooming Business Students into Future CEOs

Course Description: This course is designed for business students who aspire to become future CEOs. The course focuses on developing leadership skills, strategic thinking, and a comprehensive understanding of the various aspects of business management required to acquire the CEO role and excel in it. Students will learn through a combination of lectures, case studies, discussions, group projects, and guest lectures from experienced CEOs and industry experts.

Course Objectives:

- Develop Leadership Skills: Students will learn essential leadership skills, including effective communication, decision-making, negotiation, and conflict resolution, to effectively lead teams and organizations.

- Foster Strategic Thinking: Students will learn how to think critically and strategically, analyze complex business situations, and make informed decisions to drive the long-term success of the organization.

- Understand Business Functions: Students will gain a comprehensive understanding of various business functions, including finance, marketing, operations, human resources, and corporate strategy, to develop a holistic approach to business management.

- Learn Corporate Governance: Students will learn about the principles of corporate governance, ethical decision-making, and responsible leadership, emphasizing the importance of ethical and socially responsible practices in the modern business landscape.

- Develop Global Perspective: Students will gain an understanding of the global business environment, including international markets, geopolitical risks, cultural differences, and emerging trends, to prepare them for leading in a globalized world.

- Enhance Communication and Interpersonal Skills: Students will develop effective communication and interpersonal skills, including public speaking, presentation, networking, and relationship-building, critical for success as a CEO.

- Learn from Industry Experts: Students will have the opportunity to learn from experienced CEOs and industry experts through guest lectures, case studies, and real-world examples, providing practical insights into the challenges and opportunities of leading organizations.

- Capstone Project: Students will apply the knowledge and skills gained throughout the course to develop a strategic business plan, which will serve as a capstone project, allowing them to integrate and demonstrate their learning in a practical business context.

Course Outline:

- Introduction to CEO Role

- Strategic Thinking and Decision-Making

- Business Functions and Holistic Management

- Corporate Governance and Ethics

- Global Business and Emerging Trends

- Communication and Interpersonal Skills for CEOs

- Leading High-Performing Teams

- Change Management and Innovation

- CEO as a Visionary and Transformational Leader

- Guest Lectures and Case Studies from CEOs

- Capstone Project: Developing a Strategic Business Plan

Assessment Methods:

- Class participation in discussions and group activities

- Case study analysis and presentations

- Individual and group projects

- Written assignments

- Guest lecture reflections

- Capstone project presentation and report

By the end of this course, students will have developed the knowledge, skills, and mindset required to excel in the role of a CEO, and be prepared to take on leadership positions in the business world with confidence and competence.

Trades for March 2023

Here are my trades for Mar. Sold a few naked puts and all of them expired. Got to keep the premium.

Sold the following puts on SPXL.

Mar 17th, $59

Mar 24th, $55

Sold the following puts on AMZN.

Mar 10th, $88

Mar 24th, $90

Mar 31st, $90

Sold the following puts on OXY

Mar 24th, $52

Sold the following on TQQQ

Mar 31st, $24

All of them expired. I kept the premium!

Here are my trades in Feb. Just a repeat of Jan!

Here are my trades for Feb 2023. Sold a few naked puts and all of them expired. Got to keep the premium.

Sold the following puts on SPXL.

Feb 3rd, $65

Feb 10th, $71

Feb 17th, $58

Feb 24th, $65

Sold the following puts on AMZN.

Feb 3rd, $87

Sold the following on TQQQ

Feb 24th, $20.50

All of them expired. I kept the premium!

My trades for Jan 2023. I forgot…almost!

I have been getting a bit sloppy! Actually, I got a bit busy with classes. Here are my trades for Jan 2023. I have decided to trade a bit rather than investing for a couple of months. None of these naked puts got exercised. Hence, I got to keep the premium.

I sold the following puts on SPXL.

Jan 13th, $58.50

Jan 20th, $60

Jan 27th, $63

Jan 27th, $68

All of them expired.

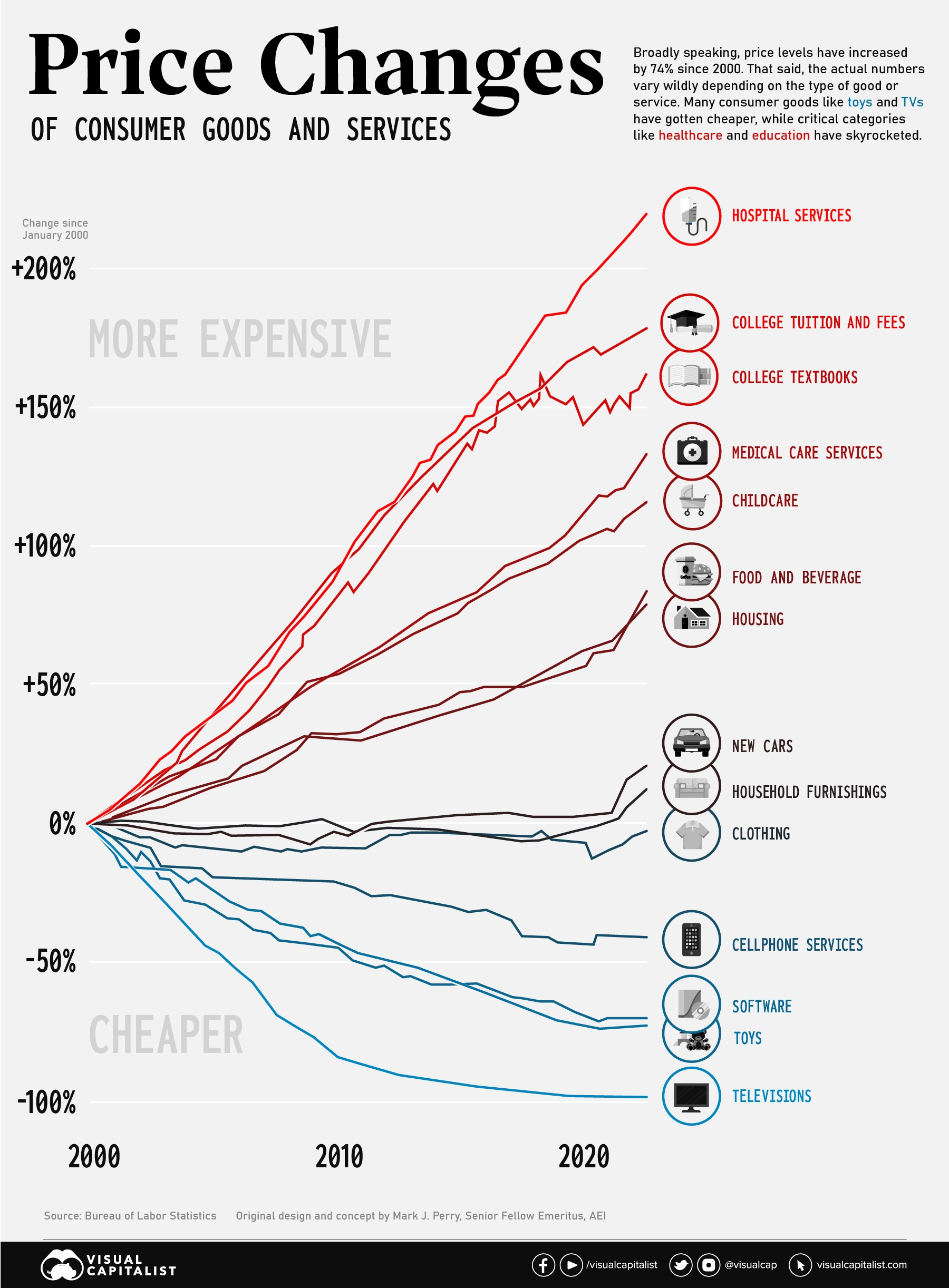

Inflation Education and Education Inflation!

Looks like many things have gotten more expensive since Y2K. Hospital services topped the list with more than 200% inflation! I’m not surprised but I take little solace in knowing that better medicines and quality treatment options may have contributed to higher costs. Can you guess which sector was a close second in high inflation? Education! To be more precise, tuition and text book costs. I wanted to start cursing when I saw that the prices in education sector in 2023 were 175% of those in 2020. Did the quality of education improve? Did the quality of professors improve? No and No! Then, what explains this unreasonable price increase? College degrees have become status symbols. Universities have figured that the society is obsessed with fancy degrees. I hate to say this, but Peter Thiel may have a point! As long as we don’t examine the ROI of college education before we enroll, universities have no incentive to care! With costs getting higher and higher, no wonder it’s called higher education! click on the image below to read the full report from WEF.

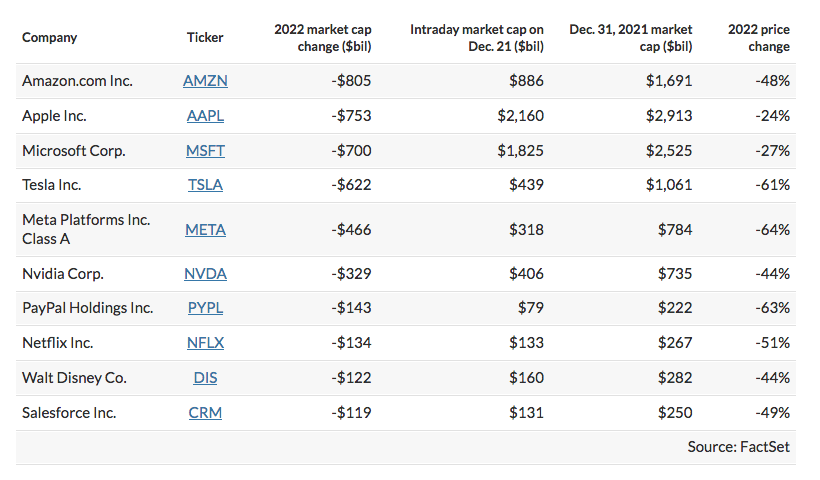

Tesla lost half its value in 2022. Many lost even more!

The year 2022 made some investors nervous, some angry, and others sad and that’s understandable. But some companies lost a lot of value. At one point, AMZN lost more than $1Trillion! Welcome to Grave New World! Click on the image to read more. But Be optimistic. Things will get better soon.! Happy New 2023!

Back in Action!

In May this year, fearing that Putin may go crazy with weapons of mass destruction in Ukraine, I decided to stay away from investing. I was right, but for wrong reasons. I would file it under ‘got lucky’ column. So on October 27th, when Facebook (called META nowadays!) fell by more than 25% and lost about 80 Billion$ in market cap, I thought I would sell some puts. I sold Oct 28th $95 puts. Thankfully, META stayed above $95 and I got to keep the premium. But by Nov 3rd, it fell to $88. I’m watching it carefully even as it reaches $113 on Nov 11th. I’ll make a decision about buying some this week. Facebook fell from $350 to $88! AMZN fell to $85 from $188 and GOOGL to $83 from $151.

My Trades for May 2022

The indices I watch SPY, QQQ, and FAS are at interesting levels – they are approaching pre-Covid levels but not there yet. Does this mean these indices won’t go down further? No. They may. Also, interest rates are coming down a bit. So I have decided to carefully and sold the following puts.

Sold 20 TQQQ June 17, $21 Puts – $0.71

Sold 20 FAS June 17, $60 Puts – $0.72

Why $21 strike price for TQQQ? That was the price it was selling in Dec 2019! I’m willing to buy TQQQ at $21.

Why $60 strike price for FAS? That’s was the price it was selling in Oct 2017! I’m willing to buy FAS at $60!

I’m willing to buy TQQQ at $21 and FAS at $60! Remember my discussion on time travel? But why June 17th? Travelling to mother India on 16th! Let’s see how these trades pan out. Good luck!

Short-term thinking leading to short-term loyalties?

“Employers view frequent job-hopping negatively,” said our invited speaker in my class today. She suggested that students avoid short-term thinking in career planning. As she was explaining, I realized that short-term thinking is ubiquitous. Could the ‘same day delivery’ service be making us ‘take one day at a time’ people? Later, I asked a friend who prefers to trade than invest long-term, his views on this topic, he made an interesting statement:

When CEOs manage by quarterly earnings, technologies/business models change rapidly, Netflix stock loses 30% and Twitter gains 25% in one day, and cryptocurrencies challenge the currencies issued by governments, you want me to think long-term! Are you breathing Oxygen or snuffing paint?

His response was valid. My friend thrives on volatility, especially as a trader, in daily and hourly volatility. However, does frequent job-hopping by employees send a signal to future employers? Employers are more likely to perceive job-hopping negatively, and understandably so. I recommend that those changing jobs often learn to articulate the reason for switching jobs often. For instance, moving from one job to another in pursuit of learning opportunities and not merely for a few extra bucks is understandable. But employees must be able to document what they learned and how it will help future employers.

About my friend’s question about breathing Oxygen or not, nowadays in many cities in California, it does feel like I’m sniffing paint when I’m outdoors. That’s on a good day!

Mr. Ashutosh Garg on improving the quality of business education

Mr. Ashutosh Garg addesses how the quality of business education may be improved by inviting practitioners to the classrooms. A global corporate executive, serial founder, and a CEO advisor, he discusses his experience as a visiting faculty to schools around the world in a recent interview. I invited him to address my audience at a Faculty Development Program.

My Feb 2022 Trades

I stayed away from the market in Dec and Jan. Here are my trades for Feb. I’m not sure what’s going to happen in Ukraine. So going to stay in cash and away from investing till end of June.

Sold 5 puts – FAS strike price 110 for Feb 4th – $450 – Expired.

Sold 3 puts – FAS strike price 120 for Feb 11th – $390 – Expired.

Sold 5 calls – FAS strike price 130 for Feb 18th – $2000 – Expired.

Sold 5 puts – FAS strike price 85 for Feb 18th – $950 – Expired.

Sold 5 puts – TQQQ strike price 35 for Feb 18th – $700 – Expired.

Sold 20 puts – SPXL strike price 70 for Feb 18th – $1400 – Expired.

The slides, R code, and the images I used in the IOT class

Please install R and R-Studio before you try Google Vision APIs.

Calling Googlevision APIs using R Language

Click here for the slides I used in the class

Click here for Key IOT Networks comparison

Here is the code I used in R to demonstrate Google Vision APIs. Remember to install R, R studio, and other libraries first.

========================================

# library(rjson) # to get credentials for Google Cloud Console

library(“rjson”)

creds = fromJSON(file=’C:/Downloads/credentials.json’) # Retrieve Credentials file from cloud console

options(“googleAuthR.client_id” = creds$installed$client_id)

options(“googleAuthR.client_secret” = creds$installed$client_secret)

options(“googleAuthR.scopes.selected” = c(“https://www.googleapis.com/auth/cloud-platform”))

googleAuthR::gar_auth_service(json_file=”C:/Downloads/credentials.json”)

imagePath <- “C:/Downloads/Taj.jpg”

gcv_get_image_annotations(

imagePaths = imagePath,

# feature = “FACE_DETECTION”,

feature = “LANDMARK_DETECTION”,

maxNumResults = 7

)

imagePath <- “C:/Downloads/CarsAndDog.jpg”

gcv_get_image_annotations(

imagePaths = imagePath,

# feature = “LABEL_DETECTION”,

maxNumResults = 10

)

================================

My Trades for December 2021

Back to selling naked puts! But traded on FAS for fun. Here are my trades for Dec.

Transactions

Bought 200 FAS at $124.00 and sold at $126.60.

Sold 10, Jan 22, TQQQ 60 puts for $1.70 & Bought it back at $0.03. Any idea why?

Sold 10, Jan 22, RIVN 70 puts for $3.30 (too attractive to pass)

Sold 10, Jan 22, RIVN 55 puts for $1.45 (too attractive to pass)

Sold 10, Jan 22, PTON 35 puts for $1.40 (just experimenting)

My trades for November 2021

First, I closed all my October trades on Nov 4th and booked my profits though the options were expiring in Jan. Why? I don’t trade on margin. I don’t want to go long either. So, back to selling naked puts! Here are my trades for Nov.

Transactions

Sold 10, Jan 22, SPXL 70 puts for $0.90

Sold 10, Jan 22, RIVN 70 puts for $3.30

Sold 10, Jan 22, RIVN 55 puts for $1.45

Sold 10, Jan 22, PTON 35 puts for $1.40

My trades for October 2021

Per popular request, I’ll be posting my monthly trades hereafter. Though the request was for weekly posts, I’ll start with monthly for now. I traded only naked puts last month and here they are. Guess how much capital I need if all the puts are exercised? Guess how much profit I would make if none is exercised?

Transactions

Sold 10, Jan 22, FAS 65 puts for $2.22

Sold 10, Jan 22, TQQQ 60 puts for $1.70

Sold 5, Jan 22 TQQQ 65 puts for $2.05

Sold 5, Jan 22 TQQQ 70 puts for $1.65

Sold 5, Jan 22 TQQQ 70 puts for $1.34

Any idea why Jan 22 TQQQ 70 puts were sold at different prices?

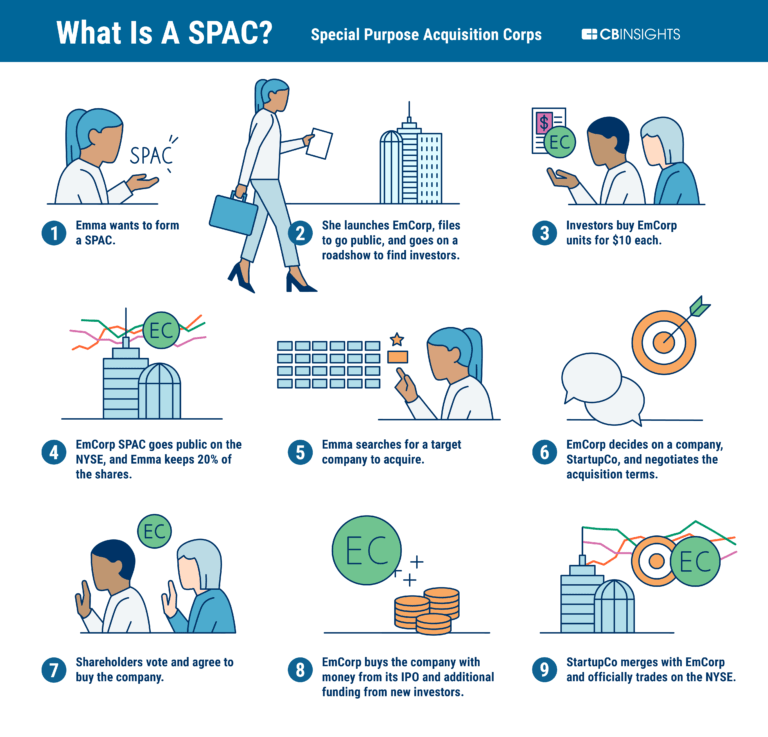

Remermber my warning about SPAC? What are SPAC’s responsibilities in IPO?

Trevor Milton, the founder of Nikola, a EV manufacturer lied “nearly about all aspects of the business” acording to the U.S. Attorney’s Office in Manhattan. Did the SPAC that took Nikola public drop the ball and cause this debacle? Would the traditional vetting process have eliminated this quagmire? Prosecutors say, “To make it appear the truck prototype was driving, it was towed to the top of a hill and then rolled down to the bottom.” Click the images below and read on….

My last post on Negative Interest rates! I promise.

Remember our lengthy discussion on negative interest rates in the Fintech class? In these unusual times, so many truisms about finance are becoming untrue. In Denmark, a country with a long history of negative interest rates, the central bank announced 20 year home mortgages at a fixed interest rate of zero percent. A 20 year, $100,000 mortgage at 3% APR would cost a homeowner $33,000.00 in interest. But this begs many important questions. Will the rental market be impacted badly? Will home prices not appreciate? Click on the image below to read further.

Investing in SPAC is not for everybody. Tread carefully!

I said in the class I will explain how options differ from SPAC. Here it is.

SPAC (Special Purpose Acquisition Company) is a shell corporation with no current business operation but has identified/is identifying potential targets for acquisition/merger. Upon completing the M/A, the SPAC goes public and those who invested in the SPAC get IPO shares allotted by the company. Whereas options are contracts between two parties (the company is not involved) either to buy or sell shares at a particular price within a specific period. The shared are moved from one investor to another if the options are exercised. SPAC issue warrants to the investors to begin with. To read more about SPAC click on the image below.

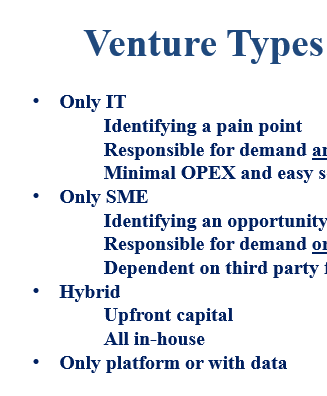

I classified the entrepreneurs who create software platforms under 3 categories.

In the class I discussed that while creating hosted platforms that bring demand and supply together to transact, entrepreneurs may restrict their roles solely to developing the platform and hosting it, to functioning exclusively as Subject Matter Experts who hire third party software developers, or to acting as both SMEs and software developers. Which option an entrepreneur picks depends on his/her background and other exogenous and endogenous factors. I agree it may be argued that certain types have inherent disadvantages/disadvantages and that’s up for discussion. Click the image below to download the slides I used in the class. Hope you had some takeaways and points to ponder from this class. I admire your entrepreneurial drive and enthusiasm. I didn’t spend much time on monetizing APIs and if you have questions, please contact me in my Stanford email ID.

Can options trading influence valuation? Looks so, just as we discussed in PE class

Remember our discussion on how call and put volumes are used by some investors to measure sentiments? Investors who buy ‘out-of-the-money’ call options anticipate the underlying stock price to spike. Recenly Softbank bought $4B worth call options on its holdings AMZN and MSFT. Many investor interpret this move as a buy signal on these equities and this may have led to spike in prices. This ends up escalating the valuation of these companies even though the underlying business models don’t justify these levels of valuation. Click on the image below to read an interesting article on this topic.

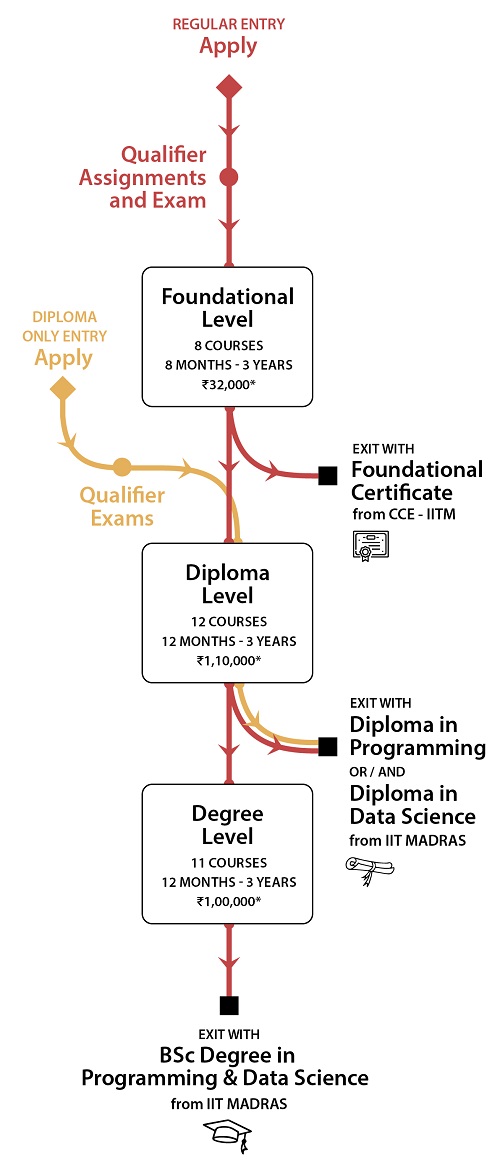

IIT Madras launches online Bachelor, Diploma in Datascience and Programming

It’s here finally! It has been my dream that a reputed school in India offer an online undergrad degree in Computer Science and now IIT-M is doing it. Now it’s open to all. Well, almost to all. I wish IIT-M opened it to all, not solely to those who completed 12th grade! I see a big demand for this course and wish IIT-M success. This is going to open doors to so many poor, bright students. Please send me your views to my Stanford email ID.

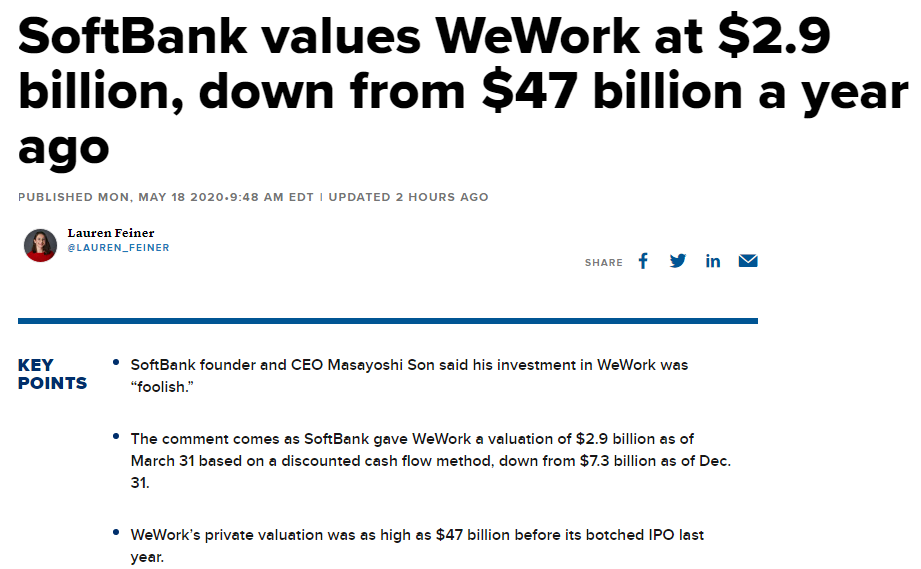

‘Valuation’ I said ‘is an art and a science’. I should have said ‘forensic science’.

WeWork was valued at $47 Billion in January 2019. In April 2020, it’s valued at $2.9 Billion. CNBC also reported ” Prior to the IPO filing, the coworking-space company was expected to seek a valuation as high as $100 billion”. Imagine that! As I said valuation is an art and a science. Looks like I should have said “foresic science”! Read on by clicking the image below and send me your views to my Stanford email ID.