I said in the class I will explain how options differ from SPAC. Here it is.

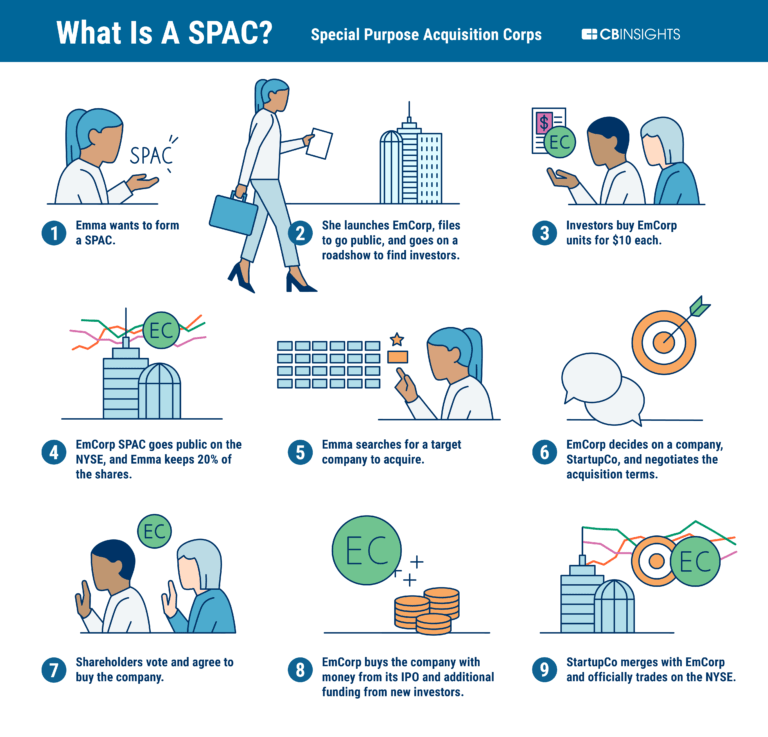

SPAC (Special Purpose Acquisition Company) is a shell corporation with no current business operation but has identified/is identifying potential targets for acquisition/merger. Upon completing the M/A, the SPAC goes public and those who invested in the SPAC get IPO shares allotted by the company. Whereas options are contracts between two parties (the company is not involved) either to buy or sell shares at a particular price within a specific period. The shared are moved from one investor to another if the options are exercised. SPAC issue warrants to the investors to begin with. To read more about SPAC click on the image below.